CYBER STRATEGY

IN A BOX

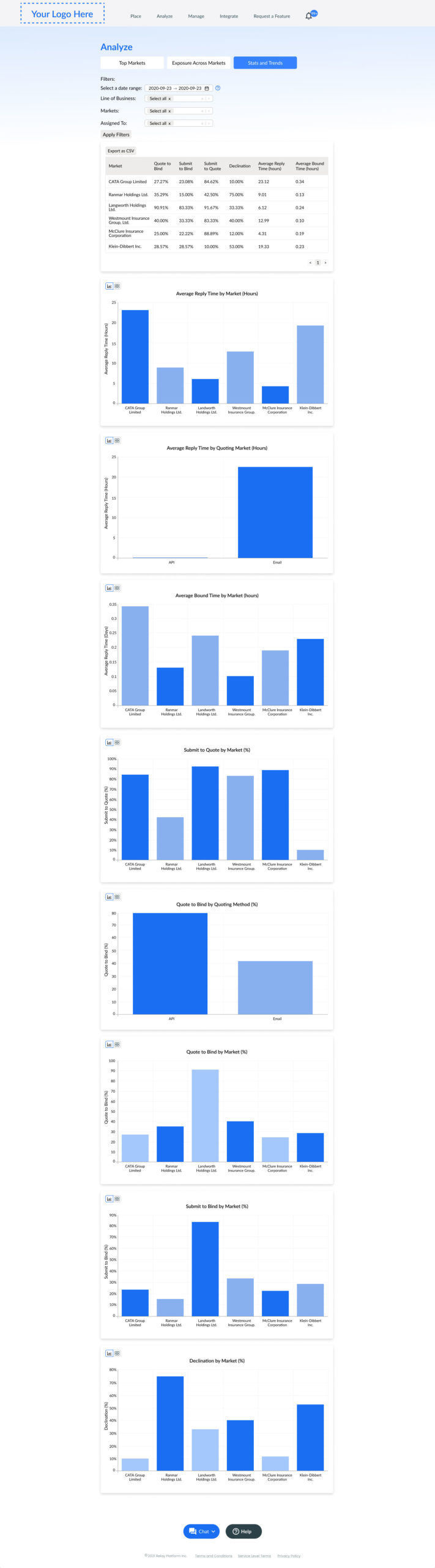

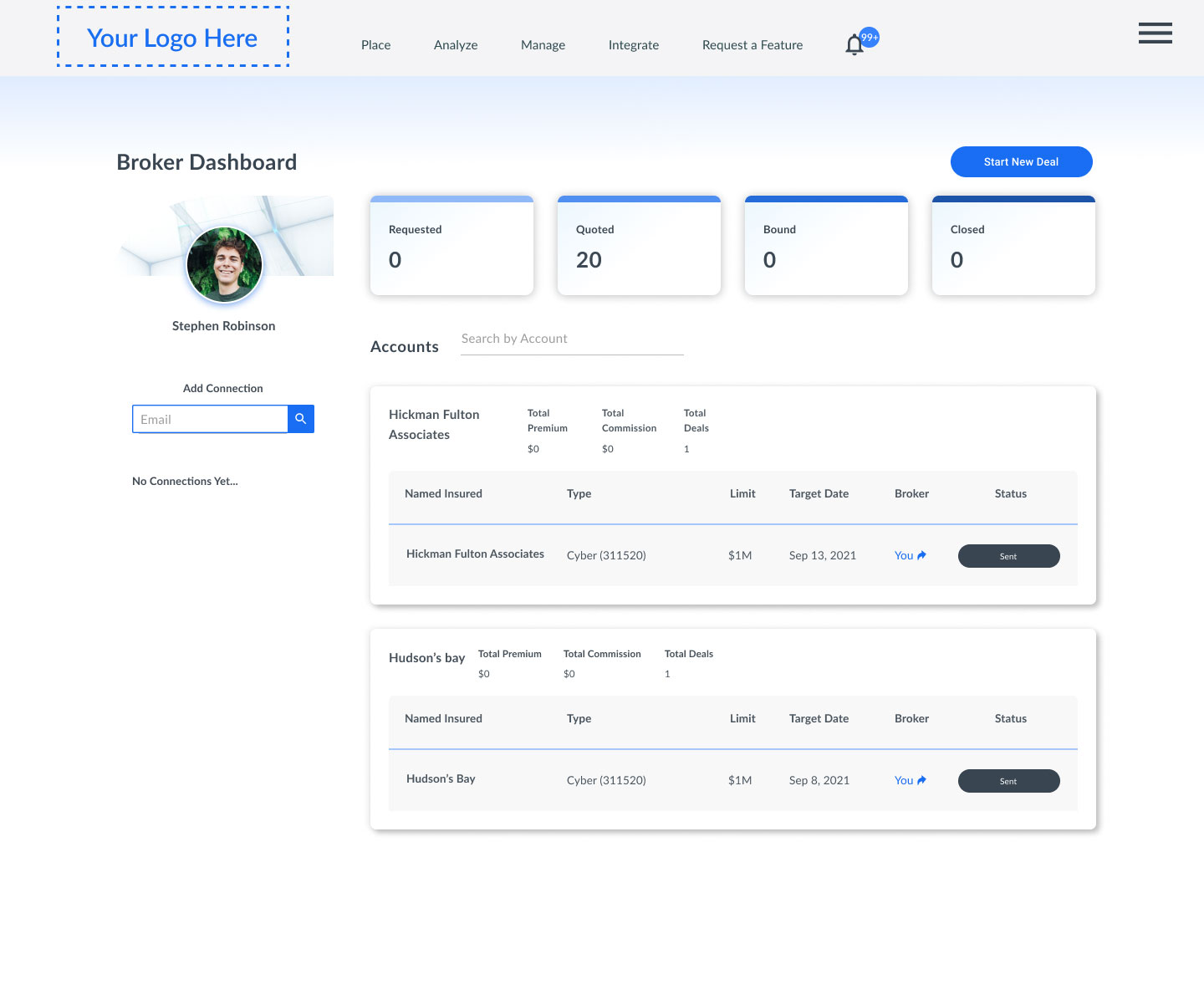

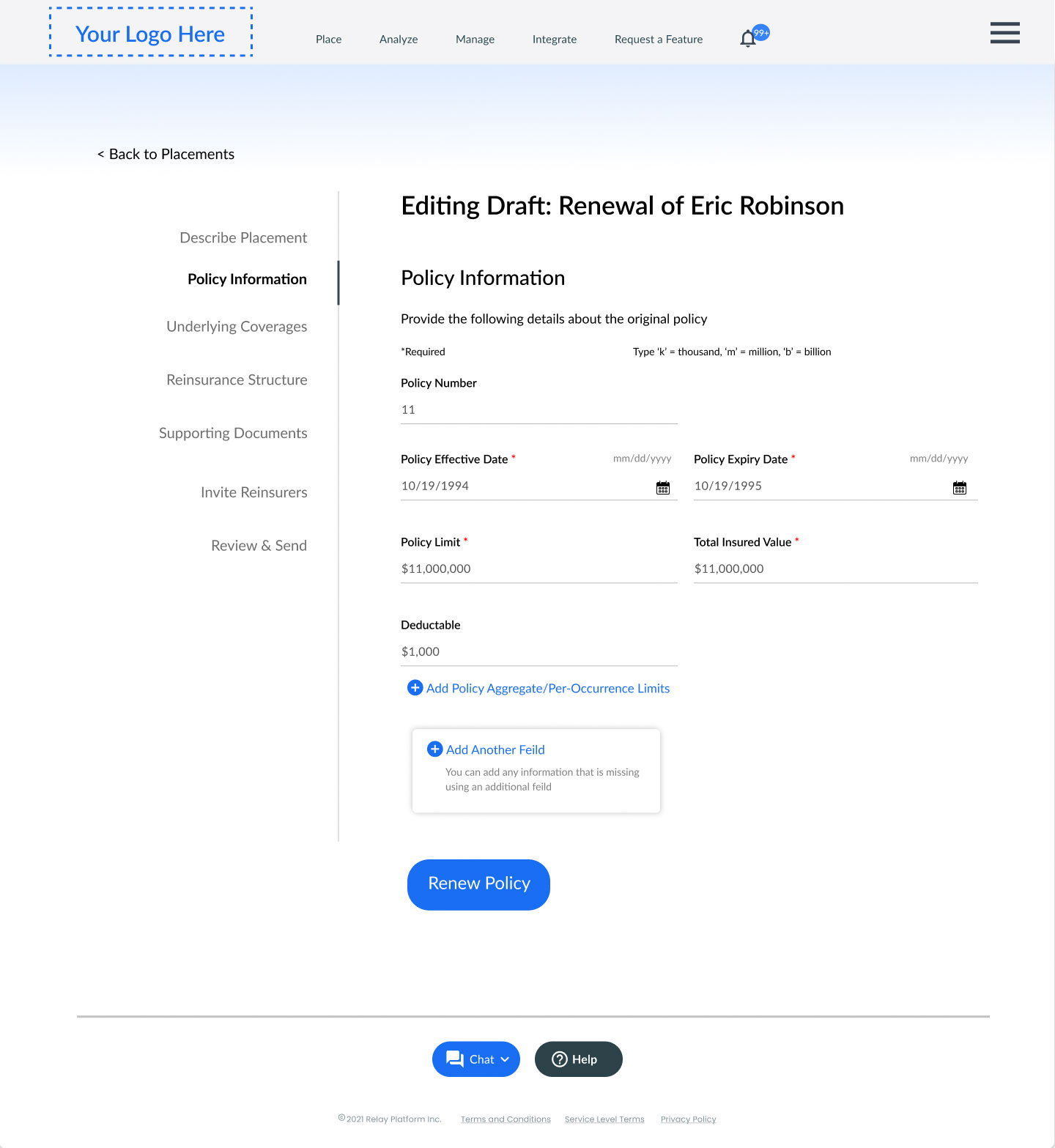

- Increase and easily manage deal flow

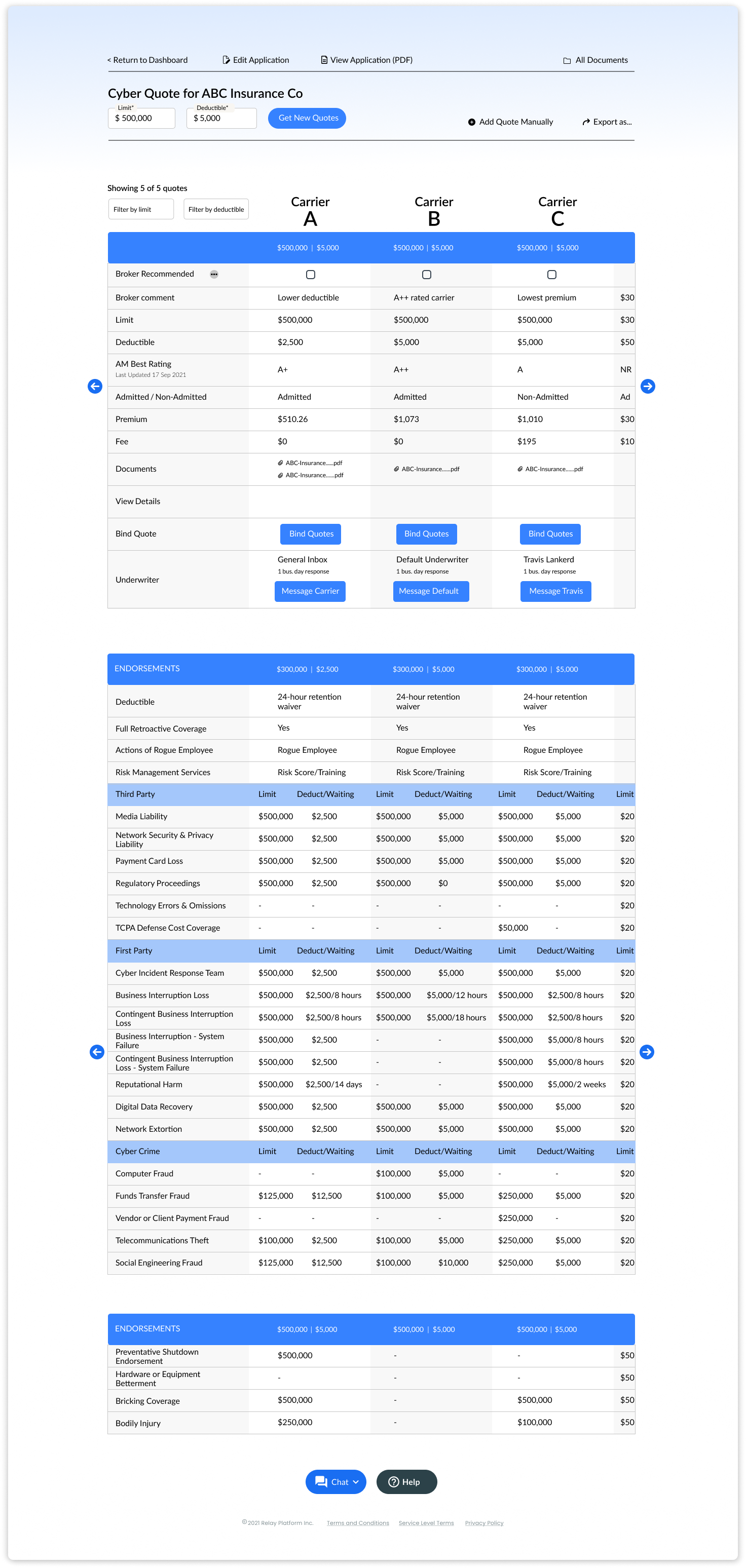

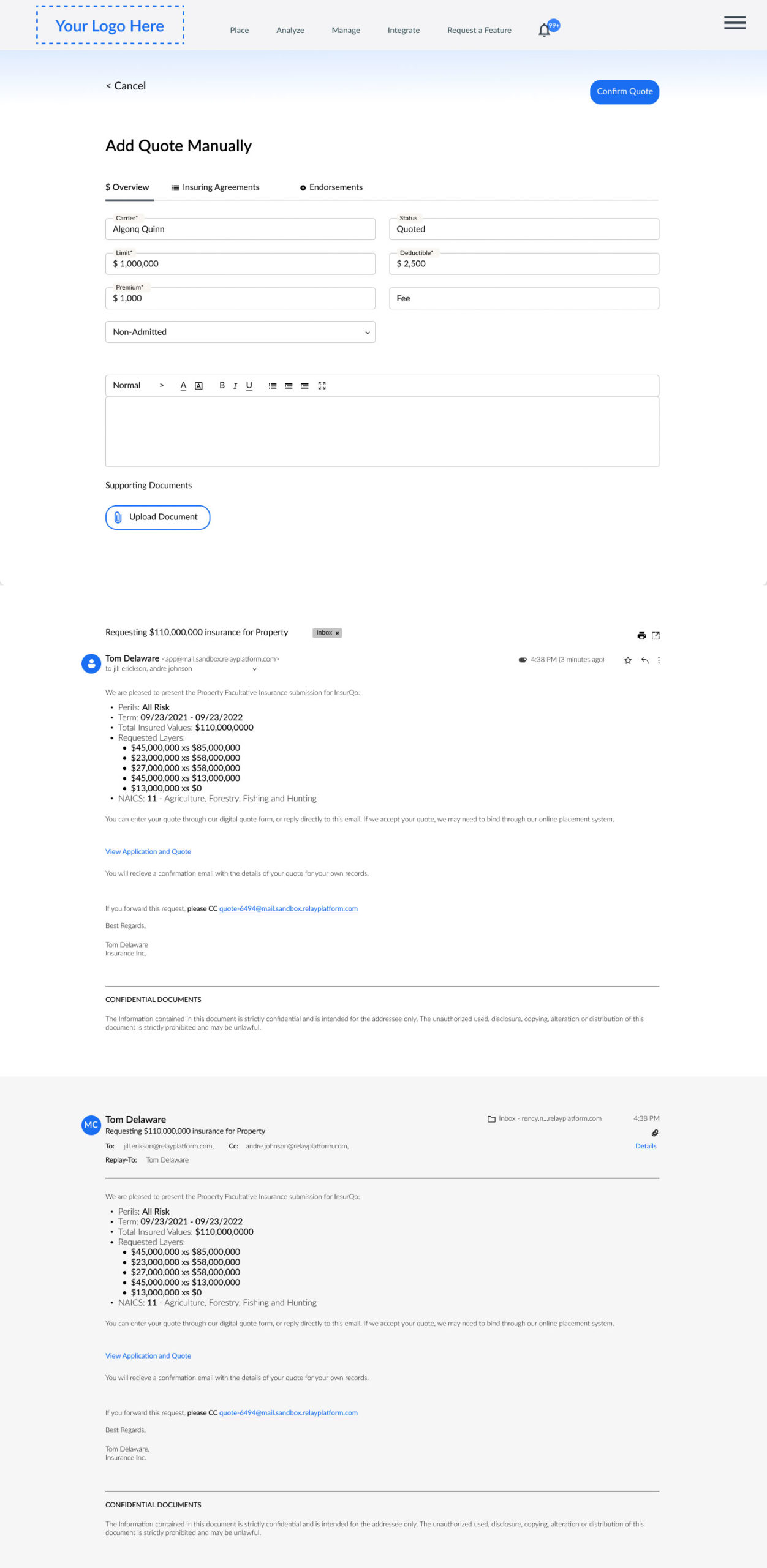

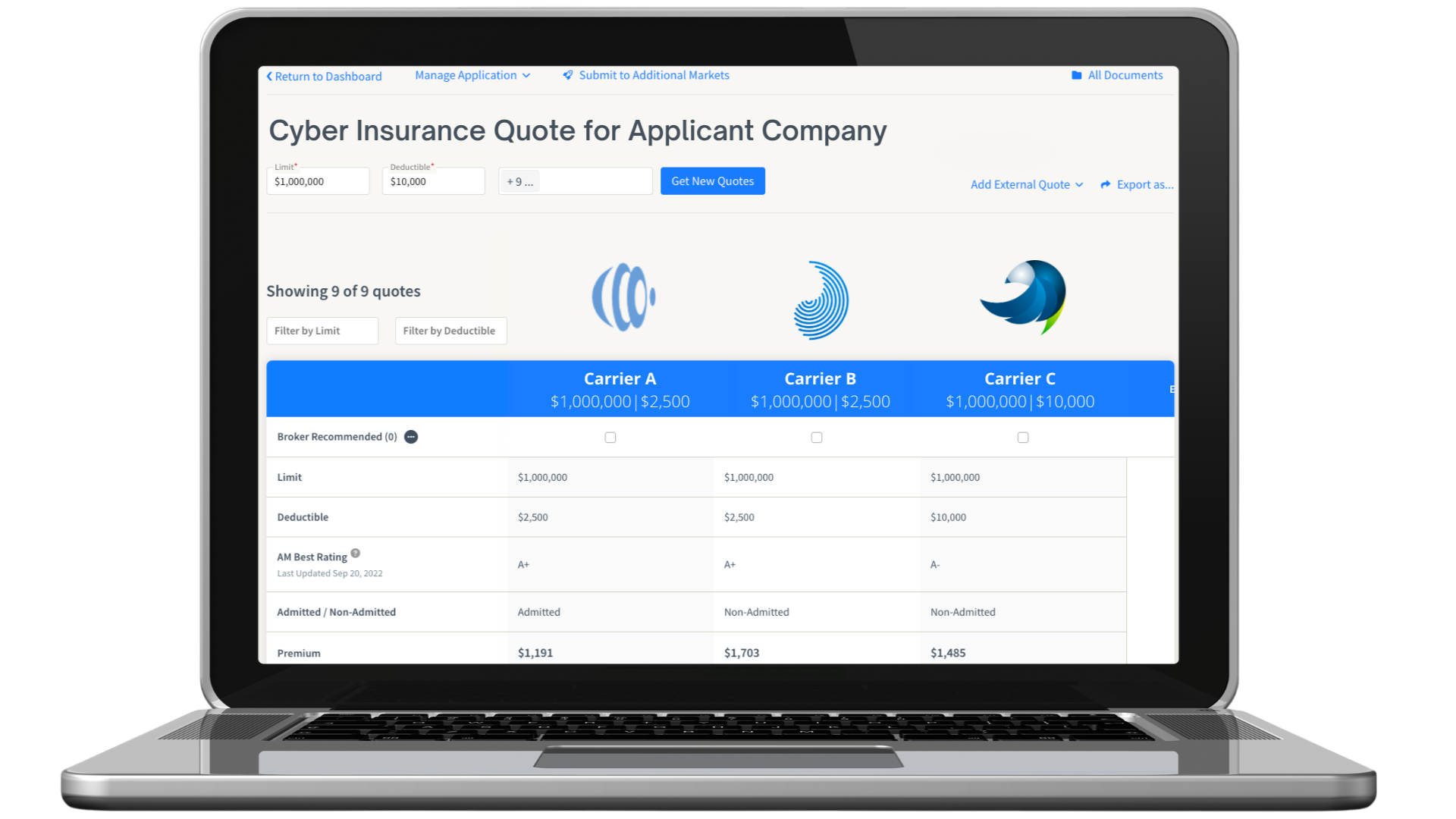

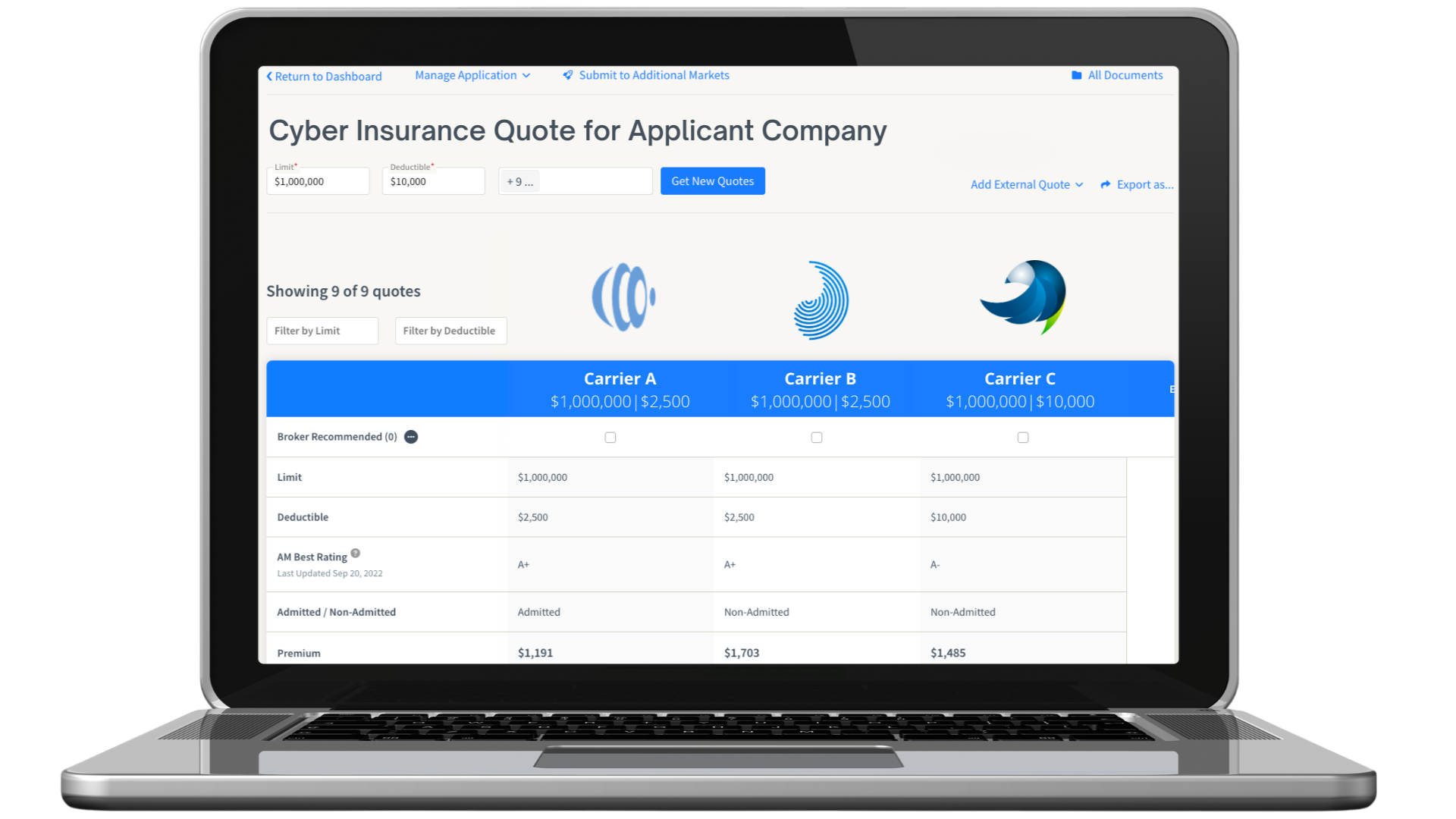

- Streamline access to both digital-first & traditional carriers

- Leverage modern insurance technology through generative AI

Proudly working with trusted capacity providers and industry leaders:

Trusted By Industry Leaders

We don’t like to brag, but…

Helping partners achieve their most aggressive sales goals – it’s just what we do.

Total Insured Values

Fetched Quotes

Faster Proposal Generation

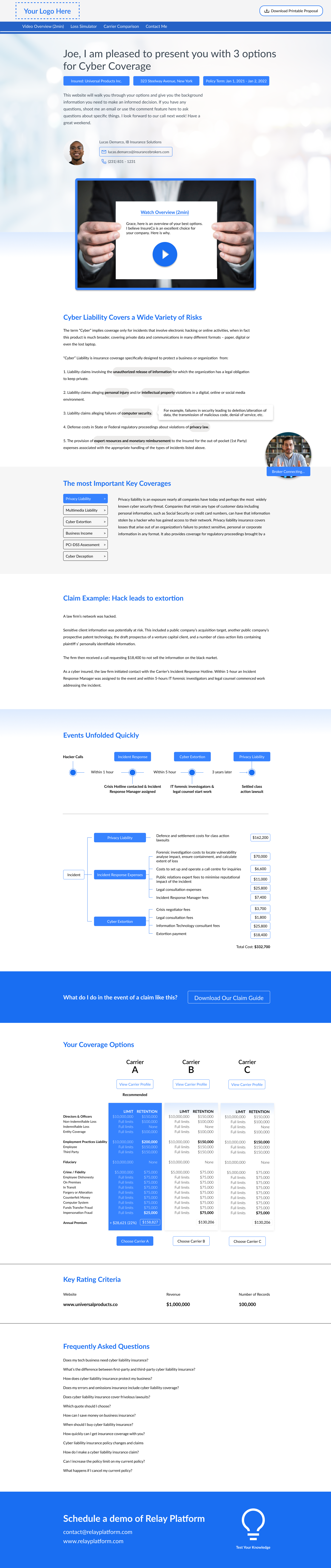

Market and Remarket Better Than Ever Before

Walk Through Our Solution

Relay in the News

Stay up to date with all things Relay.

Ready to learn more?

Relay saves customers 10 hours a week in prospecting for quotes alone.

What would you do with an extra 2+

hours per day?

hours per day?

That’s an extra: 20 calls per day, 2 extra coffees, 1 extra lunch meeting or 2 rounds of golf per week